Two key ingredients are in place. But we need to get started now.

In a previous post, we warned about the Zettabyte video tsunami – and the accompanying flood of challenges and opportunities for video publishers of all stripes, old and new.

Real-life tsunamis are devastating. But California’s all about big wave surfing, so we’ve been asking this question: Can we surf this tsunami?

The ability to do so is going to hinge on economics. So a better phrasing is perhaps: Can we profitably surf this video tsunami?

Two surprising facts came to light recently that point to an optimistic answer, and so we felt it was essential to highlight them.

1. The first fact is about the Upfronts – and it provides evidence that 4K UHD content can drive growth in top-line sales for media companies.

The results from the Upfronts – the annual marketplace where networks sell ad inventory to premium brand marketers – provided TV industry watchers a major upside surprise. This year, the networks sold a greater share of ad inventory at their upfront events, and at higher prices too. As Brian Steinberg put it in his July 27, 2016 Variety1 article:

“The nation’s five big English-language broadcast networks secured between $8.41 billion and $9.25 billion in advance ad commitments for primetime as part of the annual “upfront” market, according to Variety estimates. It’s the first time in three years they’ve managed to break the $9 billion mark. The upfront finish is a clear signal that Madison Avenue is putting more faith in TV even as digital-video options abound.”

Our conclusion? Beautiful, immersive content environments with a more limited number of high-quality ads can fuel new growth in TV. And 4K UHD, including the stunning impact of HDR, is where some of this additional value will surely come from.

Conventional wisdom is that today’s consumers are increasingly embracing ad-free SVOD OTT content from premium catalogs like Netflix, even when they have to pay for it. Since they are also taking the lead on 4K UHD content programming, that’s a great sign that higher value 4K UHD content will drive strong economics. But the data from the Upfronts also seems to suggest that premium ad-based TV content can be successful as well, especially when the Networks create immersive, clutter-free environments with beautiful pictures.

Indeed, if the Olympics are any measure, Madison Avenue has received the message and turned up their game on the creative. I saw more than a few head-turning :30-second spots. Have you seen the Chobani ads in pristine HD? They’re as powerful as it gets.2

Check out this link to see the ads.

2. The second fact is about the operational side of the equation.

Can we deliver great content at a reasonable cost to a large enough number of homes? On that front, we have more good news.

The Internet in the United States is getting much faster. This, along with advanced methods of compression including HEVC, Content Adaptive Encoding and Perceptual Quality Metrics, will result in a ‘virtual upgrade’ of existing delivery network infrastructure. In particular, Ookla’s Speedtest.net published data on August 3, 2016 contained several stunning nuggets of information. But before we reveal the data, we need to provide a bit of context.

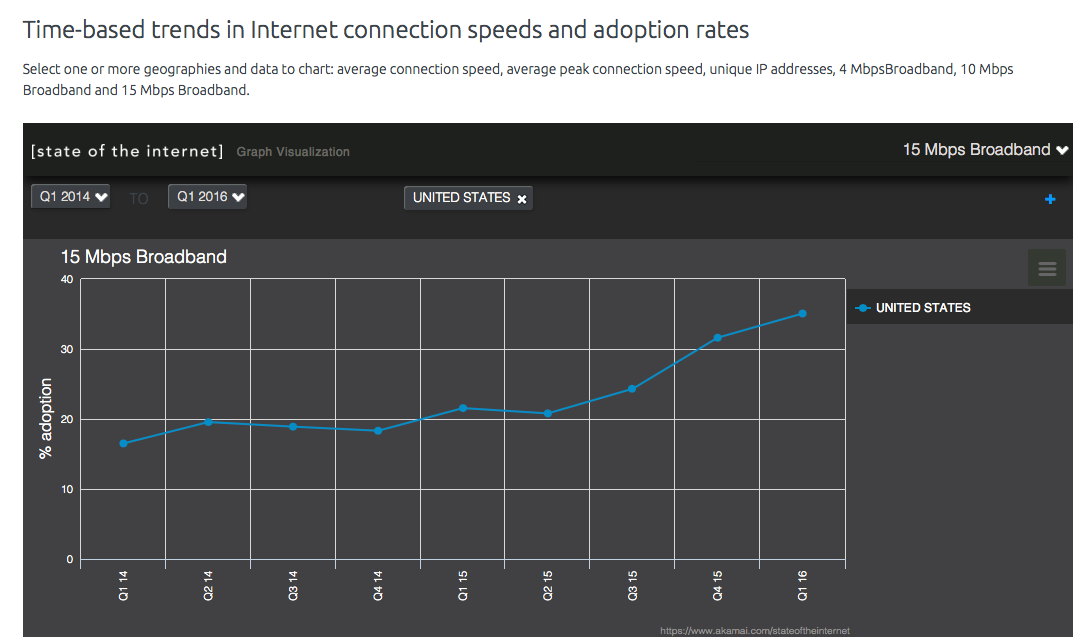

It’s important to note that 4K UHD content requires bandwidth of 15 Mbps or greater. Let’s be clear, this assumes Content Adaptive Encoding, Perceptual Quality Metrics, and HEVC compression are all used in combination. However, in Akamai’s State of the Internet report released in Q1 of this year, only 35% of the US population could access broadband speeds of 15 Mbps.

(Note: We have seen suggestions that 4K UHD content requires up to 25 Mbps. Compression technologies improve over time and those data points may well be old news. Beamr is on the cutting edge of compression and we firmly believe that 10 – 15 Mbps is the bandwidth needed – today – to achieve stunning 4K UHD audio visual quality.)

And that’s what makes Ookla’s data so important. Ookla found that in the first 6 months of 2016, fixed broadband customers saw a 42% year-over-year increase in average download speeds to a whopping 54.97 Mbps. Even more importantly, while 10% of Americans lack basic access to FCC target speeds of 25 Mbps, only 4% of urban Americans lack access to those speeds. This speed boost seems to be a direct result of industry consolidation, network upgrades, and growth in fiber optic deployments.

After seeing this news, we also decided to take a closer look at that Akamai data. And guess what we found? A steep slope upward from prior quarters (see chart below).

To put it back into surfing terms: Surf’s Up!

References:

(1) “How TV Tuned in More Upfront Ad Dollars: Soap, Toothpaste and Pushy Tactics” Brian Steinberg, July 27, 2016: http://variety.com/2016/tv/news/2016-tv-upftont-networks-advertising-increases-1201824887/

(2) Chobani ad examples from their YouTube profile: https://www.youtube.com/watch?v=DD5CUPtFqxE&list=PLqmZKErBXL-Nk4IxQmpgpL2z27cFzHoHu