Fresh back from the Consumer Electronics Show in Las Vegas, where it seemed everything that can be connected will be – and anything that displays video may now be properly called a TV – I noticed a unifying constraint that doesn’t appear to be easing up: The issue of how to maintain network stability amidst the barrage of data, stemming from the ever-expanding stream these new devices and experiences consume.

Put simply, bandwidth and capacity matters more than ever – and consumer behavior is shifting accordingly. Empowered consumers, now aware of the immense data requirements that video carries, are making choices about which service, ISP or mobile network to use based on total cost – not simply quality or the depth of catalog.

For the first time we are seeing customers who understand that high definition (HD) video requires three times the data as standard definition (SD). Many are able to relate this tradeoff to what it means on their screen, whether that be a 60” TV in the living room, or 4.7” iPhone display. While budget is of the highest concern for some, others are seeking the quickest streaming experience, and then there’s a group that counts on the highest video quality, no matter the cost.

There will always be a niche consumer population willing to pay for the very best experience, whether in the form of an Italian sports car, or a top-loaded data plan to view a full HD experience. But for our discussion I wish to focus on the mainstream, defined as the largest user segment where the intersection of experience and cost is the driving factor for making their ISP decision.

Consider that Netflix just announced a major initiative to re-encode their entire library so they can achieve a 20 percent reduction in bit-rate while maintaining quality. Then as follow-up we have T-Mobile’s Binge On program, which promises to enable unlimited streaming from select service providers all without added cost to the consumer. As a Netflix and T-Mobile customer, my wallet is cheering right now!

While the success of Netflix has been a catalyst for OTT (Over-the-Top), it is clear that the digital entertainment content services market – now valued between $10 to $12 billion – is coping with a changing set of risks, opportunities, regulatory issues and competition. Let’s take a look specifically at some of the major trends and market drivers for OTT in 2016, starting with content:

It’s good to be king (and own content)

Content is king and it is the content owners that get much of the credit for the massive success of streaming video service models. However, the mishmash of content licensing agreements across services and panoply of business models, forces viewers to navigate multiple apps. This is due to the myriad of confusing permissions and content rights that present a real hurdle to the user experience for online video. Across living rooms around the country a familiar scenario plays out every night, where individuals and families spend as much time navigating services as they do actually watching entertainment content. Sound familiar?

Regretfully, licensing will continue to be an issue in 2016 as there is no incentive for content owners to restrict licensing to fewer distributors. The more the merrier is their mantra and with every new video upstart planning to take on the establishment (Apple, Amazon, Netflix, VUDU, etc.), additional licensing dollars come rolling in. Of note, it was this fierce competition for streaming rights that became one of the driving reasons Netflix, Amazon and others began investing in original content. And ironically investment in original content could be the mechanism that loosens the grip content owners have on pricing, business models and availability. Or, will it merely force the content owners to compete directly with their licensees, something they largely avoided.

Many OTT services are entering into the realm of original content, and the major networks, studios and media companies are considering why they remain beholden to distribution channels that seem to be devaluing and creating more direct competition. We’re also seeing that rates of cord cutting are being exaggerated and consumers are showing signs of being willing to obtain (and pay for) content outside the established pay-TV ecosystems such as cable, satellite or a telco-operated service.

What it means to go consumer direct

The business model for the majority of large media companies over the last three to four decades has been to leverage distribution partnerships similar to how physical product manufacturers rely on a network of distributors who maintain crucial retailer relationships. After all, it is the pay-TV provider that has the customer’s credit card on file, not the NBC-Universals of the world. This is also the advantage Apple and Amazon have. With hundreds of millions of credit cards on file you could say they have the ultimate “captive” customer base.

If we look at Disney and Warner Bros. they are in market today with various services that are direct to consumer, while at the same time delivering the same content via distribution license agreements to OTT players like Netflix, Hulu, VUDU, M-GO, Amazon Prime and others. In the case of content owner operated services, a new capability must be developed in order to build and operate the infrastructure for encoding, billing and distributing digital video in a direct provider relationship with the consumer. This may sound simple, but not for a media company, whose expertise is in creating and developing high quality compelling content with mass appeal. This is a very different discipline compared to what is needed to operate a reliable video distribution service at scale.

However, technical advances over the last five years, along with the development of turnkey video workflows (online video platforms), has narrowed the gap between what is available and what must be built – to the point that it is now possible to build a credible streaming video service without developing specific components. Cloud storage and content distribution bandwidth is purchased on-demand, and encoding technologies can now be bought off-the-shelf, as a service – capabilities that even five years ago typically required a 50-100-person team to operate and maintain. Now, a small workforce of seven to ten working with the right partners and vendors, is all that is needed.

Bandwidth vs. quality

Mobile carriers, networks and pay-TV providers are seeking strategic ways to bolster their infrastructure and create compelling consumer offers (particularly aimed at millennials). Leading OVP vendor Ooyala recently stated that providers are going big on technology but also getting back to basics. They’ve realized that infrastructure, wired or wireless is their competitive advantage, and a major source of profit as screens proliferate in size and quantity.

The concept of improving quality through streaming OTT content is a noticeable shift from a few years ago, when streaming was thought of as a lower-quality alternative to broadcast. But now we find OTT video quality in some cases is ahead of broadcast platforms, where 1080p Ultra HD (4k) and High Dynamic Range (HDR) are not as widely available due to legacy equipment constraints.

The issue is network congestion, since the highest quality video experiences require a significant amount of bandwidth that is not always available. Just when it seems distribution technology has caught up with the performance ability of our devices, we find that the gap has actually widened. This is why innovation is being actively pursued in the area of distribution, beginning with more efficient encoding approaches that work in tandem with technologies like HEVC, to bring a further 40 percent reduction in file size.

Binge On vs. metered billing

T-Mobile recently announced Binge On, allowing their customers the option to tradeoff quality for the lowest cost possible, free. With video consumption on mobile devices outpacing other screens, T-Mobile is making a bold statement to both sides of the ecosystem that they are a willing co-participant in the bandwidth-quality-price dance. For service providers or content owners, the ability for their customers to affordably access content will obviously have a huge impact on usage, thus it’s not hard to see why T-Mobile made friends with the service providers here. And for consumers, who don’t want more? While every other carrier gleefully tracks your data, sending a fat bill for all those late night Netflix and chill sessions, T-Mobile says, “don’t worry, it’s on us”. If this all sounds pretty fantastic, it’s because it is. But as we know, nothing is free and there are tradeoffs.

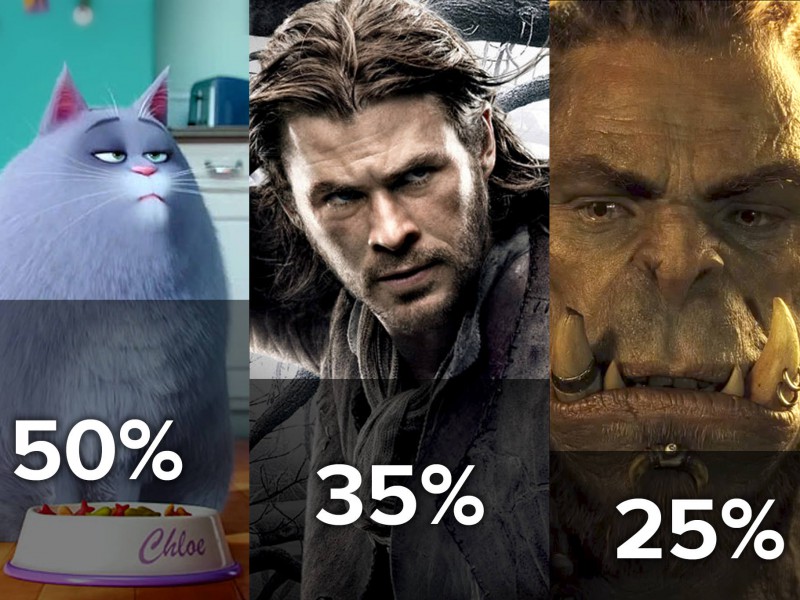

In an earlier post we covered the issue of reduced quality, or put more accurately, resolution. It turns out that a typical SD video may be encoded at 1mbps. But for an HD video, more like 3mbps or even higher is required. This means that by simply moving down to SD resolution, a viewer can watch 3x more video for the same cost. Or from the service provider perspective, including the network, you can deliver 3 times more traffic with the same infrastructure. As a strong consumer advocate, Beamr believes the customer should have choice, and we applaud T-Mobile on their ingenuity to deliver a solution with very high consumer benefit. However, we also believe that there are consumers who will appreciate the savings aspect of Binge On, but will also notice the reduction in resolution. In time, T-Mobile must adopt a more sophisticated media optimization solution, which can preserve quality and resolution while reducing file size.

Coming back from CES it wasn’t hard to learn about smaller broadband operators looking to gain a better understanding of network traffic and implementing plans to tackle or take advantage of the popularity of OTT content. While many haven’t finalized their strategy to handle competition, they expect changes in the future, as the global OTT service market continues to grow.

Media optimization hit the headlines in 2015 as one way to ensure quality thanks to Netflix’s announcement that it was experimenting with ways to reduce bandwidth, while providing the same (or better) viewing experience through media optimization. We were thrilled to witness the world’s top OTT content distributor acknowledge the tremendous need for such innovation.

Growing pains

The OTT race is nowhere close to the finish line as more value-added services such as unlimited streaming plans, faster speeds and proprietary OTT services are being planned for launch in 2016 and beyond. The industry, while experiencing exponential growth, is at a crossroad reminiscent to the time when broadcasters first faced the rise of cable. Business model challenges to the incumbents are being mounted on all fronts, while innovative technologies like content-adaptive media optimization will help pave the road to success, taking any content service or networks business “over the top”.